UAE REAL ESTATE ANALYSIS: DUBAI & ABU DHABI

UAE REAL ESTATE ANALYSIS: DUBAI RENTS UP OVER 20%, ABU DHABI SALES PRICE STABLE

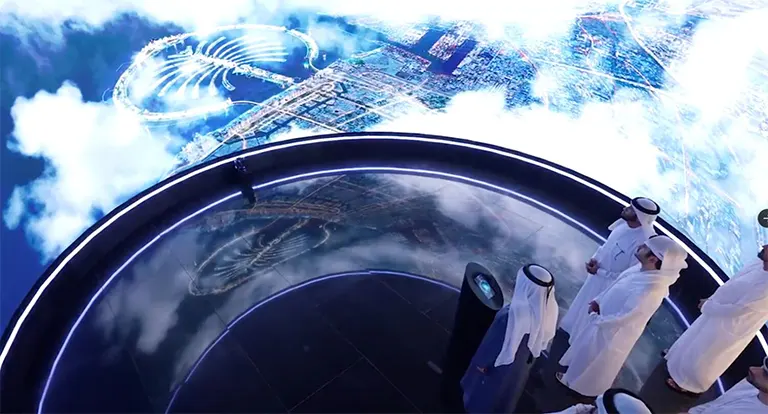

The remarkable resilience displayed by the property markets in Dubai and Abu Dhabi against the backdrop of rising interest rates and inflation is a testament to the enduring appeal of these two cities as global investment hotspots. Asteco's insights into the Q2 2023 performance shed light on the exceptional growth and stability within these real estate sectors.

In Dubai, where the real estate sector has outperformed its global counterparts, the delivery of over 20,000 units, primarily apartments, underscores the city's commitment to meeting the growing demand for housing. As the supply of villas is expected to rise, Dubai's real estate landscape demonstrates its ability to adapt to evolving market dynamics. The robust growth in apartment, villa, and office rentals, translating to impressive annual rates, not only reflects the strong demand for different property types but also highlights the attractiveness of the rental market for investors seeking consistent returns.

.

Furthermore, the incremental increase in Dubai's sales prices on a quarterly and annual basis signals a sustained appetite for homeownership. This demand is driven by various factors, including the city's reputation as a cosmopolitan hub, its strong economic fundamentals, and its world-class amenities and infrastructure. The combination of rising sales prices and consistent rental growth paints a favorable picture for both investors and end-users in Dubai's real estate market.